With its 4Q earnings report, Kimberly-Clark showed that brands still matter—even in categories with intense private label pressure. The Texas-based personal care company, which manufactures various paper products, saw organic sales increase 6 percent for the full fiscal year. “Overall, our results were strong,” CEO Michael Hsu told investors, “and I’m encouraged by the way we executed in 2020.”

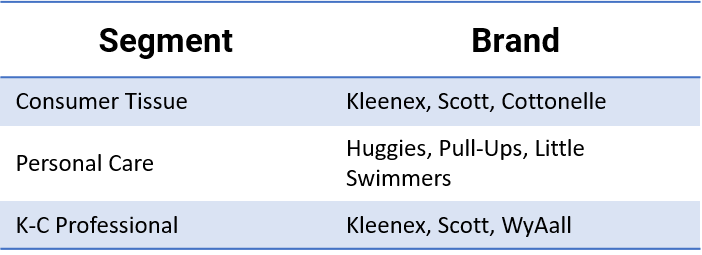

One thing that COVID-19 taught us is that in times of crisis, consumers flock to trusted brands. Led by Kleenex, K-C’s Consumer Tissue segment saw organic growth of 13%. Personal Care, headlined by Huggies, followed with an impressive 6%. Meanwhile, the professional segment, which primarily services paper products to offices, struggled, dropping 7%. The year’s success comes with a new set of problems. They’re good problems to have but need to be managed.

Kimberly-Clark is expecting a level of commodity inflation in 2021

Most consumer product companies take simple raw materials and process them into finished goods. The value of the processing is reflected in the overall brand and price premium it can command. However, no matter how great the company is at engineering and branding, at the end of the day, the profitability of Kimberly-Clark is somewhat dependent on raw material prices. This year’s success reduced the amount of raw material available for next year—which could decrease its margins.

Michael Hsu outlined some of the company’s expectations:

So, if I tick through a few things, virgin pulp, we’re expecting inflation, and that follows a year and a half of very low pricing. So virgin pulp, we’re looking for it to be up high-single digits on average. Polymer resin, we’re expecting to be up significantly, 30% or maybe even higher in North America. Nonwovens and superabsorbent will follow that but to a lesser degree. Those dynamics are largely supply driven at this point. Recycled fiber, we’re expecting to be up mid-teens; distribution costs, we’re expecting to remain inflationary, and that’s mostly due to industry’s supply constraints. And other materials such as third-party purchased safety gloves and PPE and KCP are facing significant increases if you — if you look at what’s happening in those markets. So that’s — that’s the assumption for 2021.

How CPG companies have typically handled price increases

One of the easiest ways to handle commodity inflation in consumer goods is to pass the cost onto consumers. However, this isn’t as simple as increasing prices a few percentage points across the board. Manufacturers don’t set the price of their finished goods on shelves—retailers do. Retailers are more apt to pass a price increase along than a price decrease, but they also have category margin expectations. Suppose Kimberly Clark wants to raise prices by 3 percent. In that case, a retailer can maintain their own profitability goals by substituting a portion of K-C’s shelf space to competitors or private label who isn’t raising prices. For seemingly this reason, Hsu explicitly ruled out broad-based list price increases.

Another option is to adjust pack size. If a standard Huggies box contains 124 diapers, K-C could maintain the price, but reduce the count to 96—allowing them to charge more for less. However, this decision has big long-term impacts. Not only from a consumer perspective, but a production and sales. Paying more for less is never a consumer preference, but perhaps equally important is that production lines and sales plans are optimized for the current pack-counts. Determining the specific SKU to adjust is a big undertaking.

Luckily for K-C, there’s a discipline determined to help them understand where to target.

Kimberly-Clark plans to use Revenue Growth Management to manage inflation

Revenue Growth Management (RGM) is a popular topic in the consumer goods world. It’s popular because it’s a proven way to target specific profit areas.

Here’s how I described it last year:

Basically, it’s the ability to analyze consumer consumption data against retailer activity to identify better opportunities for trade spend to “grab those opportunities and to drive your revenues and your profits.” It may sound simple, but it is incredibly complex. Coca-Cola sells to hundreds of thousands of retailers across the globe—each with a different product assortment and level of data sophistication. Coke must not only identify the opportunities but create the right mechanisms to ensure the company executes them with the retailer.

Kimberly-Clark is looking to leverage these same insights. RGM will bring in reams of data that will allow them to understand opportunities. Currently, a 32 pack of Huggies is $8.29 at Target online. Given the current level of online competition, it seems unlikely that the company could increase this SKU price.

However, done right, RGM will allow K-C to understand the true cost of selling at each customer—by SKU. RGM uses a variety of COGS, Transportation, and Trade data to reveal profitability. Maybe they can increase the base cost of a less popular item by 25%, but make up the lost volume with a promotional coupon on the 32 pack.

Hsu explains:

With regard to the pricing, again, we do expect some significant cost inflation in the year. It’s in our plans, and that’s going to affect both the Consumer Tissue side and the Personal Care side. We’re going to take appropriate actions, and certainly that’s going to — we’re going to pull all the levers — and I’ve mentioned already certainly around cost management. But, in addition to that, it’s one of the reasons we’re very pleased that we’ve got a robust revenue growth management capability up and running globally across our regions. And the levers that we are working, I mentioned, Olivia, will be selective count changes, some selective price list price increases and then a lot of work around trade efficiency and managing through promotions.

Kimberly Clark is hoping that RGM will help them understand what leverage they have at the SKU level and bring the results to retailers—to create a more worthwhile partnership.

It will be interesting to see how it works out.

One response to “Kimberly-Clark looks to revenue growth management to combat commodity costs”

[…] year I wrote about how KMB management signaled that the company would manage inflation via targeted price increases on prem…. Well, that was wishful thinking. Last March, the company raised prices on 60% of its consumer […]